Between 2011 and 2020, mom-and-pop investors, who have kept between three to 10 homes, increased their share of home buying by 2%, compared to large- and medium-sized investors. In fact, the bulk of this buying happened between 2018 and 2020, according to CoreLogic’s Investor Homebuying report highlighting home U.S. purchase trends between 2011 and 2020.

A decade ago, there was a flurry of home purchase activity following the 2006 housing market crash as investors began capitalizing on low-cost, high-growth properties. However, this purchase activity peaked in 2018 and since then, the pace of investment has slowed. In 2019, the investment rate (the share of home purchases made by investors) in the U.S. housing market was 16.3%, and by 2020, it had slowed to 15.5%.

Despite the decreasing rates, overall, investors have maintained a strong presence in the market during the last 10 years. Smaller investors are making up a more significant share of homebuying investors than at any point in the past and continue to gain their market share at the expense of their larger counterparts. This is likely due to large out-migration from expensive areas to more affordable ones, allowing smaller investors to snap up properties at lower rates.

“At this critical juncture — the first year into the new decade and continually moving farther away from the pandemic — when the hot housing market cools down, we may see investor activity increase as they try to buy more properties at lower prices,” said Molly Boesel, principal economist at CoreLogic. “Although investors seem to have given some of their coveted market share to buyers, it’s hard to say how long this trend will last — or what the long-term implications will be on a larger scale.”

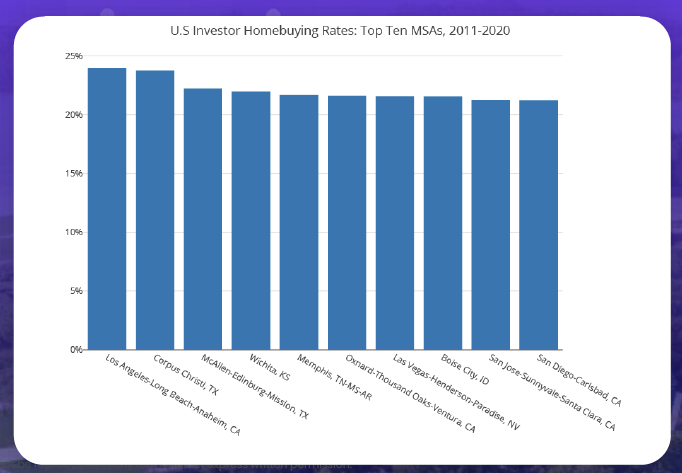

Investor home buying rates varied significantly across the country over the past decade. Rates were highest in California and Texas. These states had six of the top 10 metropolitan areas with the highest investor rates, with Corpus Christi, Texas and Los Angeles leading the way.

State and Metro Takeaways

California dominated investor activity in 2011, with Los Angeles, San Jose, San Diego, San Francisco, Sacramento, Stockton and Riverside all in the top 10 areas with the highest investor activity. Despite this, no California metro areas made the top 10* in 2020.

Cities in the Mountain West, the western Midwest and the South led investment activity by 2020, and investment has grown in metro areas like Boise, Idaho; Phoenix and Salt Lake City, as they tend to have lower prices and growing populations fueled by out-migration in California.

Conversely, investor activity was the lowest in the Northeast over the past decade, with eight of the bottom 10 metro areas representing the region. Hartford, Connecticut, had the lowest investor share at just 8%.

Additionally, investors have gained market share over the last decade as housing market turnover has increased. At the metropolitan level, there appears to be a good correlation between the two. It seems that increasing investor activity goes hand-in-hand with market turnover, or the percentage of homes that are sold.