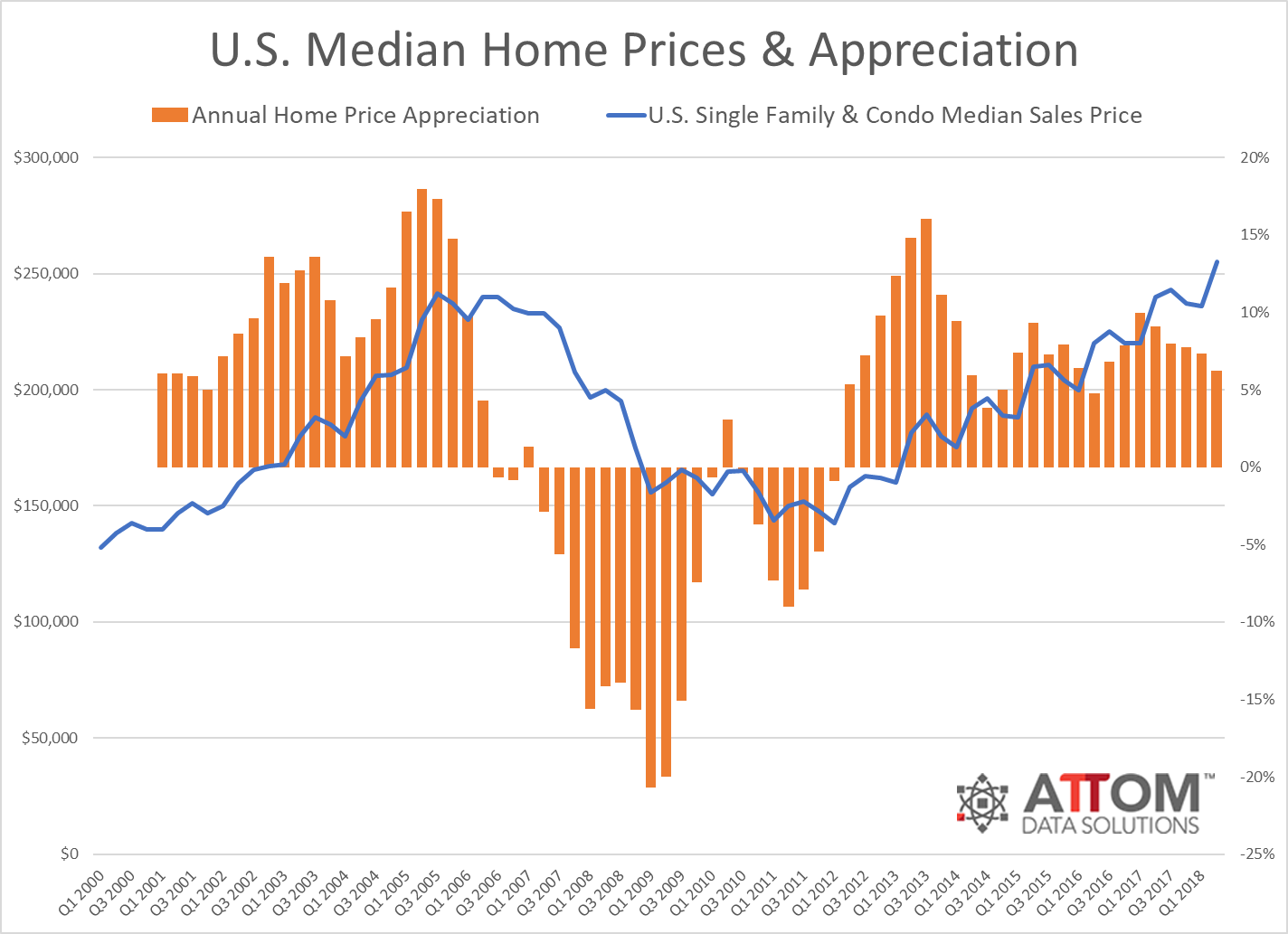

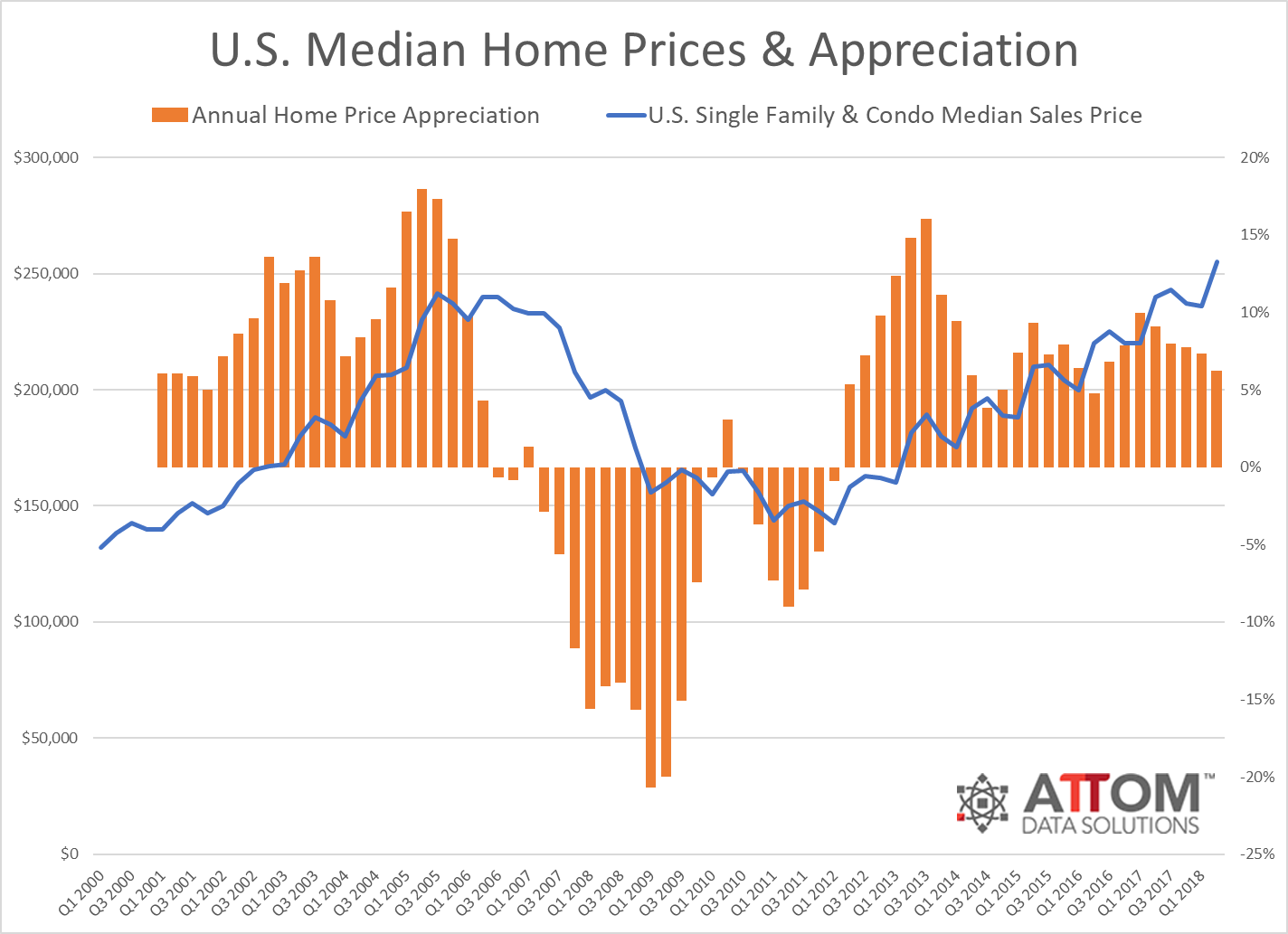

U.S. Median Home Price Appreciation Decelerates In Q2 2018 to Slowest Pace In Two Years

“Annual median home price appreciation nationwide has now slowed for five consecutive quarters following a post-election spike to double-digit appreciation in the first quarter of 2017,” said Daren Blomquist, senior vice president at ATTOM Data Solutions. “Although home sellers are still in the driver’s seat of this housing market, moderating median home price appreciation is good news for prospective homebuyers and signals that rising mortgage rates and other housing headwinds are cooling red-hot home price appreciation in some areas.”

ATTOM Data Solutions curator of the nation’s premier property database, today released its Q2 2018 U.S. Home Sales Report, which shows single-family homes and condos sold for a median home price of $255,000 in the second quarter, up 6.3 percent from a year ago to a new all-time high but the slowest annual appreciation since Q2 2016.

Historical U.S. Home Prices & Appreciation

(Source: ATTOM Data Solutions)

(Source: ATTOM Data Solutions)

Annual median home price appreciation slows in 66 percent of local markets

Annual median home price appreciation in Q2 2018 decelerated from the previous quarter in 80 of the 122 metros (66 percent) analyzed for median home prices, including Los Angeles, Chicago, Dallas-Fort Worth, Houston and Philadelphia.

Counter to the national trend, annual median home price appreciation accelerated from the previous quarter in 42 of the 122 metros analyzed (34 percent), including New York, Washington, D.C., Boston, San Francisco and Detroit.

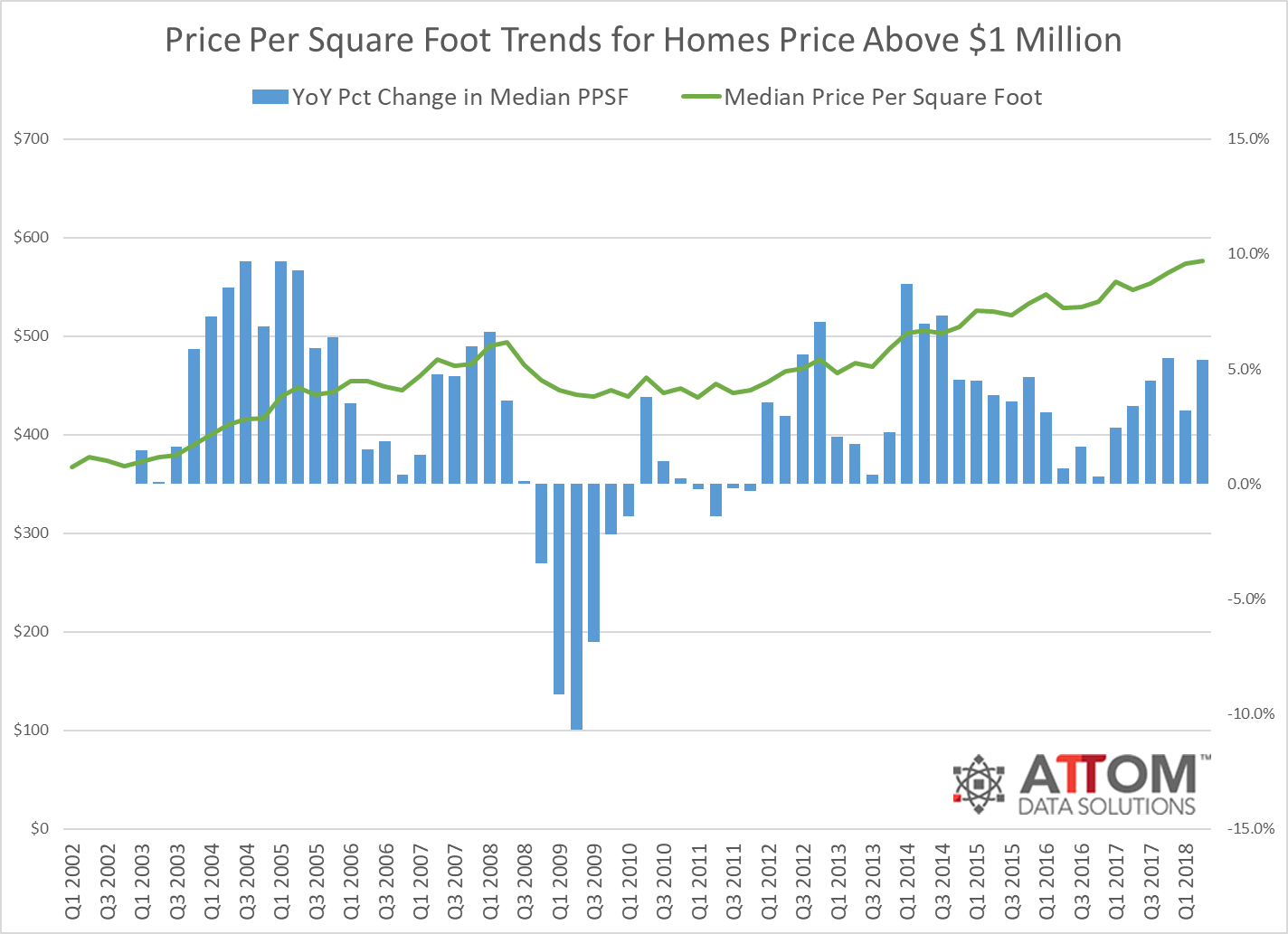

Price-per-square foot appreciation accelerates for homes selling above $1 million

The median price per square foot for homes that sold for $1 million or more in the second quarter increased 5.4 percent from a year ago, accelerating from 3.2 percent annual appreciation in the previous quarter and from 3.4 percent annual appreciation in Q2 2017.

The median price per square foot for homes that sold for under $1 million in the first quarter increased 6.5 percent from a year ago, but that was down from 8.2 percent annual appreciation in the previous quarter and down from 9.0 percent annual appreciation in Q2 2017.

In 49 counties with at least 100 single family and condo sales above $1 million in Q2 2018, median price per square foot appreciation accelerated compared to a year ago in the above-$1 million category in 32 of those counties (65 percent), including Santa Clara County (San Jose), California; Orange County, California; King County (Seattle), Washington; Alameda County (San Francisco), California; and San Diego County, California.

Median price per square foot appreciation decelerated compared to a year ago in the above-$1 million category in 17 of the 49 counties (35 percent) with at least 100 single family home and condo sales above $1 million in Q2 2018, including Los Angeles County, California; Miami-Dade County, Florida; Marin County (San Francisco area), California; Maricopa County (Phoenix), Arizona; and New York County (Manhattan), New York.

$1 Million PPSF Historical Trends

(Source: ATTOM Data Solutions)

(Source: ATTOM Data Solutions)

Fastest median home price appreciation in San Jose, Flint, Seattle, Boise, San Francisco

Among 122 metropolitan statistical areas analyzed in the report, those with the biggest year-over-year increase in median prices were San Jose, California (up 25.0 percent); Flint, Michigan (up 23.7 percent); Seattle, Washington (up 14.3 percent); Boise, Idaho (up 14.3 percent); and San Francisco, California (up 14.2 percent).

“Home prices in the greater Seattle region continue to grow at well above long-term averages for several reasons,” said Matthew Gardner, chief economist with Windermere Real Estate, covering the Seattle market. “Firstly, the area’s booming economy continues to add jobs, driving up demand for housing. Compounding this demand is a lack of new construction housing, which puts substantial upward pressure on median home prices in the resale market. Housing affordability is unquestionably a major issue in Seattle; however, ironically enough, the many California buyers relocating to the Seattle area actually think our median home prices are a bargain!”

Q2 2018 Home Price Appreciation Heat Map

(Source: ATTOM Data Solutions)

(Source: ATTOM Data Solutions)

Median home prices above pre-recession levels in 65 percent of markets

The U.S. median home price of $255,000 in Q2 2018 was 6 percent above the pre-recession peak of $241,648 in Q3 2005.

Median home prices in 79 of the 122 metro areas analyzed for median home prices in the report (65 percent) were above their pre-recession peaks in Q2 2018, led by Houston, Texas (79 percent above); Dallas-Fort Worth (78 percent above); Greeley, Colorado (76 percent above); Denver, Colorado (75 percent above); and San Antonio, Texas (68 percent above).

Median home prices in Q2 2018 were still below pre-recession peaks in 43 of the 122 metros analyzed for median home prices (35 percent), led by Atlantic City, New Jersey (36 percent below); York, Pennsylvania (34 percent below); Salisbury, Maryland (21 percent below); Naples, Florida (19 percent below); and Trenton, New Jersey (18 percent below).

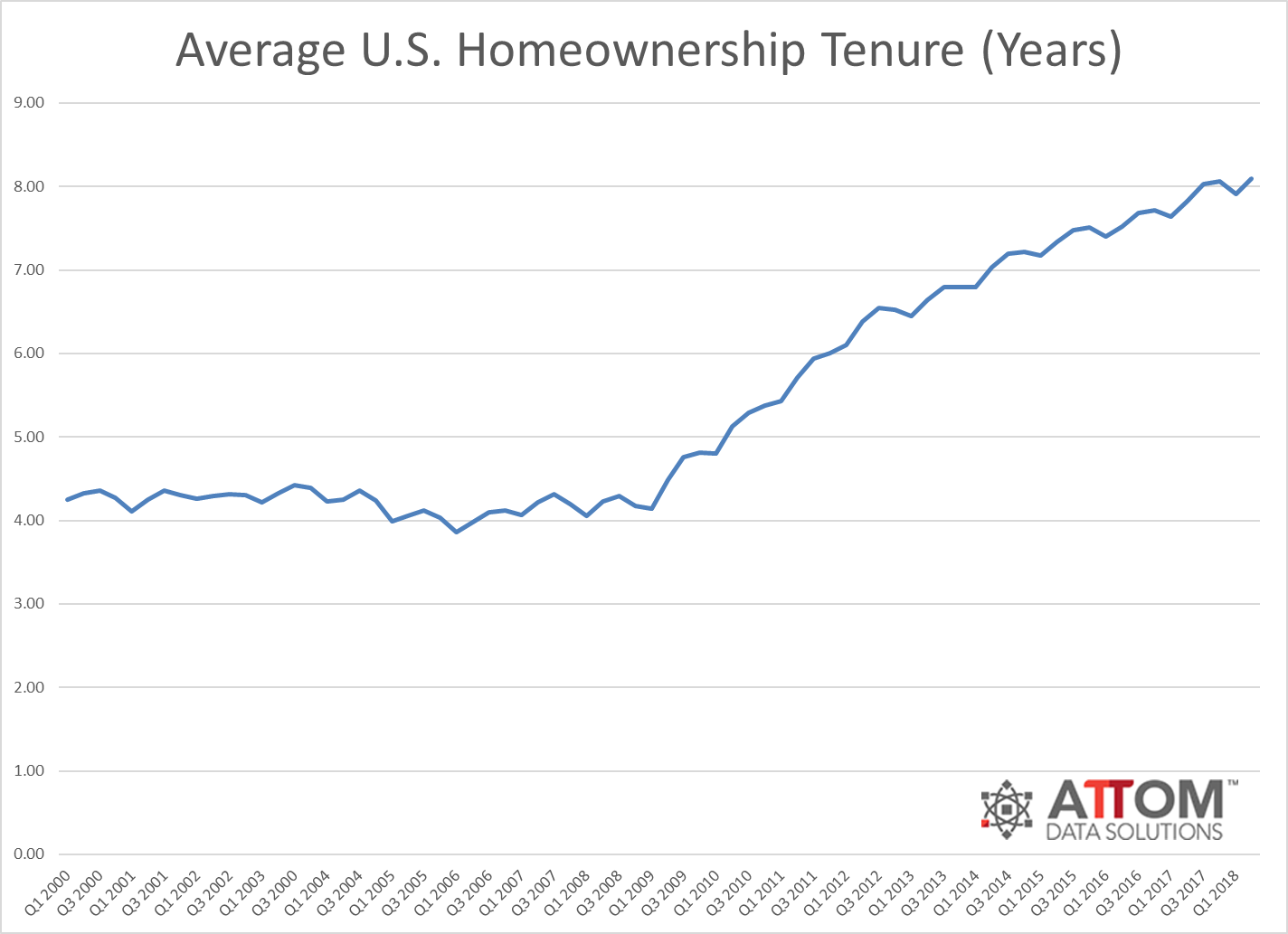

Average homeownership tenure increases to new all-time high of 8.09 years

Homeowners who sold in Q2 2018 had owned their homes for an average of 8.09 years, up from an average homeownership tenure of 7.91 years in Q1 2018 and up from an average homeownership tenure of 7.83 years in Q2 2017.

Counter to the national trend, average homeownership tenure declined in 22 of 108 (20 percent) metropolitan statistical areas analyzed for homeownership tenure, including Sacramento, California; Nashville, Tennessee; Salt Lake City, Utah; Honolulu, Hawaii; and New Haven, Connecticut.

Historical Average Homeownership Tenure

(Source: ATTOM Data Solutions)

(Source: ATTOM Data Solutions)

Average home seller gains increase to highest level since Q3 2007

Homeowners who sold in Q2 2018 sold for an average of $58,000 more than their original purchase price, the highest average home seller price gain since Q3 2007.

The $58,000 average home seller price gain in Q2 2018 represented an average 30.2 percent return on the original purchase price, up from an average 28.9 percent return in the first quarter but down from a recent peak of 30.8 percent in Q4 2017.

Among 147 metropolitan statistical areas analyzed for average home seller gains, those with the highest average percentage gain were San Jose, California (116.6 percent); San Francisco, California (85.0 percent); Seattle, Washington (76.5 percent); Boston, Massachusetts (64.3 percent); and Portland, Oregon (62.1 percent).

Distressed sales drop to an 11-year low

Distressed sales — sales of bank-owned homes, short sales, and sales to third-party investors at foreclosure auction — accounted for 11.9 percent of all single family home and condo sales in Q2 2018, down from 14.9 percent in the previous quarter and down from 13.5 percent in Q2 2017 to the lowest level since Q2 2007, an 11-year low.

States with the highest share of distressed sales in Q2 2018 were New Jersey (23.9 percent), Delaware (22.5 percent), Rhode Island (18.6 percent), Connecticut (17.6 percent), and Illinois (17.3 percent).

Among 148 metropolitan statistical areas analyzed for distressed sales, those with the highest share in Q2 2018 were Atlantic City, New Jersey (42.1 percent); Trenton, New Jersey (26.0 percent); Youngstown, Ohio (25.4 percent); Syracuse, New York (24.8 percent); and Hagerstown, Maryland (22.1 percent).

Among 52 metro areas with a population of 1 million or more, those with the highest share of distressed sales in Q2 2018 were Baltimore, Maryland (20.7 percent); Philadelphia, Pennsylvania (20.2 percent); New York-Newark-Jersey City (20.0 percent); Cleveland, Ohio (19.0 percent); and Providence, Rhode Island (18.7 percent).

Other report findings

- Sales to buyers using FHA loans — typically first-time homebuyers — accounted for 10.7 percent of all sales of single family homes and condos in Q2 2018, down from 11.9 percent in the previous quarter and down from 14.0 percent in Q2 2017 to the lowest level since Q1 2008 — a more than 10-year low.

- All-cash purchases accounted for 27.2 percent of all single family home and condo sales in Q2 2018, down from 28.8 percent in the previous quarter and down from 27.6 percent in Q2 2017 to the lowest level since Q3 2016.

- Sales to institutional investors (entities buying at least 10 properties in a calendar year) accounted for 2.0 percent of all single family home and condo sales in Q2 2018, up from 1.9 percent in the previous quarter but still down from 2.3 percent in Q2 2017.