Survey: Millennials Opt for Doorbells Before Wedding Bells

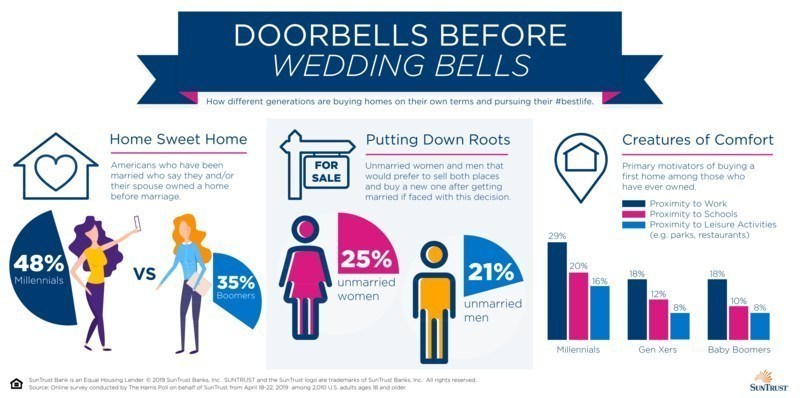

While the adage, “first comes love, then comes marriage,” may ring true, for many millennials, “first comes home, then comes marriage.” According to a recent survey conducted online among over 2,000 U.S. adults, nearly half of millennials (ages 22-38) who have been married say they and/or their spouse owned a home before marriage (48 percent), compared to only 35 percent of baby boomers (ages 55-73).

“People are choosing from many different paths and reaching common life milestones at a wider age span than before, changing when they decide to purchase a home,” said Sherry Graziano, mortgage transformation officer at SunTrust. “We want to enable financial confidence so our customers can live their best life on their own terms. This is why we are continuing to invest in technology that makes the mortgage process easier, like the option to submit a paperless mortgage application on SmartGUIDE™ and support to set healthy financial habits with the 21-day #bestlifechallenge.”

The survey found additional trends across generations

Putting Down New Roots

Today, it’s increasingly common for both parties in a relationship to own a property when entering a marriage. However, some individuals not currently married would still prefer to start fresh with their significant other and sell both properties before tying the knot. According to the survey, 25 percent of unmarried women and 21 percent of unmarried men said if faced with this decision, they would prefer to sell both places and buy a new one after getting married.

Creature Comforts

When it comes to motivations for buying their first house, millennials seem to have been driven by convenience more so than their older counterparts. According to the survey, millennials who have owned homes were more likely than their older counterparts to cite proximity to work (29 percent, versus 18 percent of Gen X and 18 percent of Baby Boomers), schools (20 percent versus 12 percent and 10 percent), and leisure activities (16 percent versus 8 percent each) as primary motivators.

“It is easier to live life to the fullest – whether you are buying a home, downsizing, or selling – when you are financially confident. While everyone has different goals, across generations and lifestyle choices, it is important to make sure your financial habits are supporting, rather than preventing, the moments that matter most to you,” Graziano said.