The economic climate is changing rapidly, and it can be difficult to understand the direction in which we should invest our business energy and steer portfolios. Were one to look at the 2023 outlooks provided by several thought leaders in the market, a neat conclusion would be difficult.

For example, according to investment bank Goldman Sachs, this downturn is different from the ones that have come before, making it all the more difficult to assess. We could take some comfort in knowing that predictions of growth for next year are still positive at 1.8%, higher than many countries in Europe who already find themselves in recessionary periods.

If we look at JP Morgan, though, they are trying to convey that 2023 will be a bad year for the economy but a better one overall for the markets. Inflation may be on the decline.

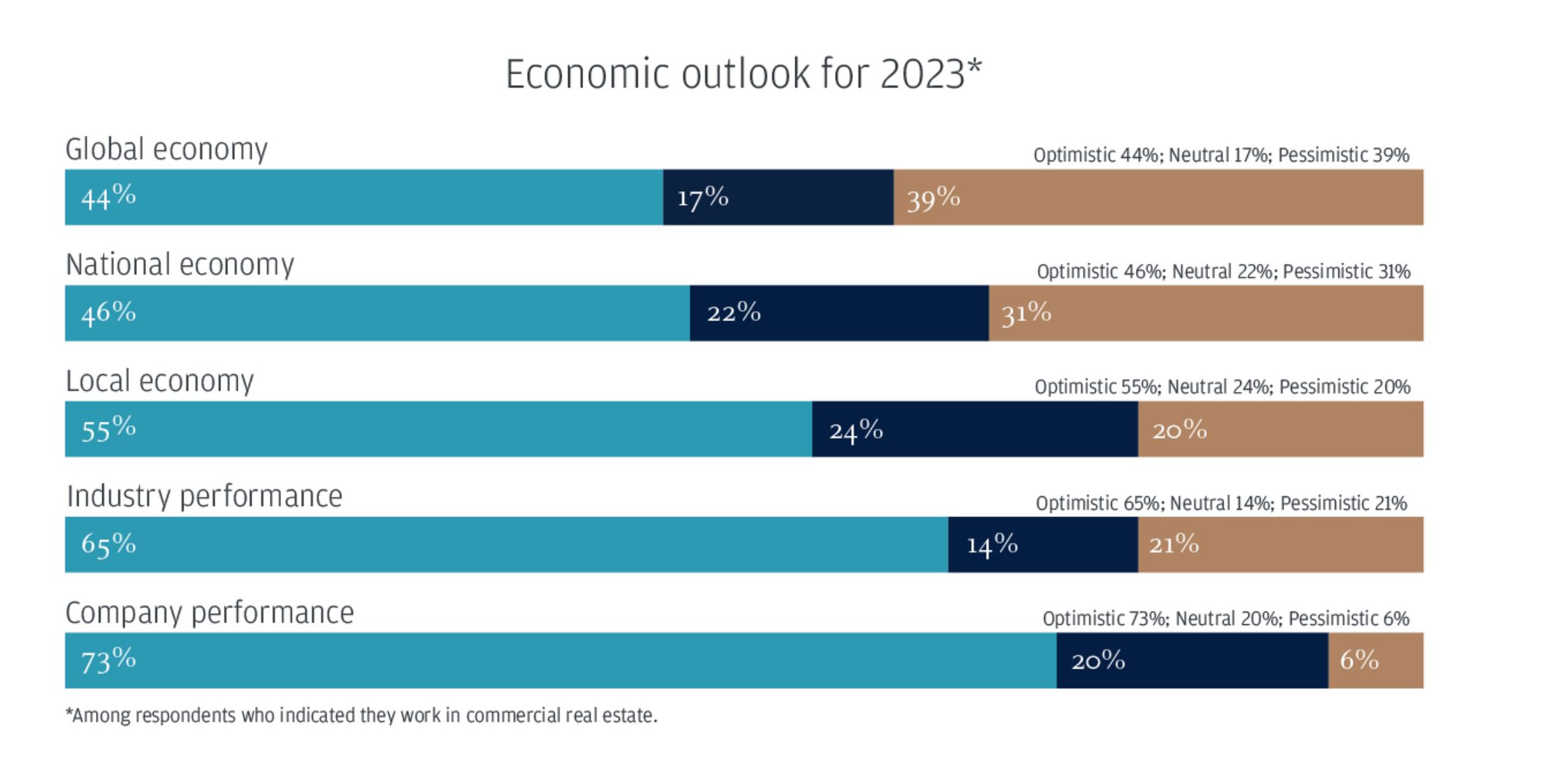

According to JPM Research, “U.S. real estate leaders are more optimistic about the national and global economies than U.S. business leaders overall.”

On the other hand, Morgan Stanley appears more optimistic in its outlook, believing that the economic foundation should remain resilient and not lead to a collapse. Meanwhile, Credit Suisse sees this period as a fundamental reset. Overall, Europe seems to be entering, or may already be in a recession and is at its most precarious point since 2008.

CBRE’s House View Economic Forecast for 2023 sees inflation decreasing to 4.1% YoY by Q4 2023, but also sees unemployment percentage increasing steadily as the year progresses.

So who is right?

With the uncertainty surrounding the global economy, investors are struggling to make informed decisions. It’s difficult to know who and what to believe given that reports vary depending on who has interests at stake.

My team and I are approaching every deal with fresh eyes and freedom from previous opinions. The market has shifted, but no one knows where it will end up. We aim to evaluate projects on their own merits and with the new credit fundamentals in mind. Moreover, we’re increasingly focused on partnering with the right developers that have impeccable character and experience throughout different cycles.

Where we’re seeing the most opportunity today is projects where we can provide “rescue” capital. These are otherwise strong projects with great developers that have hit delays due to forces generally outside of their control, typically construction slowdowns or rising interest rates.

This provides us the ability to partner and bring fresh capital to the table at favorable, risk-adjusted terms on mostly-finished assets that are in a lease-up or sale phase. The developer is then able to complete the project, protect their equity, and capture the remaining upside.

Diversifying your investments can be a great way to strengthen your financial portfolio during volatile times.

Joe Berko is the CEO and co-founder of Astor Realty Capital.