Recent Home Price Increases Fuel Sellers’ Optimism

Recent consumer findings from a National Association of Realtors®survey reveal that many more Americans believe that now is a good time to sell a home. The second quarter of 2019 saw a jump in optimism in selling, with 46% strongly holding that belief, up from 37% in the first quarter.

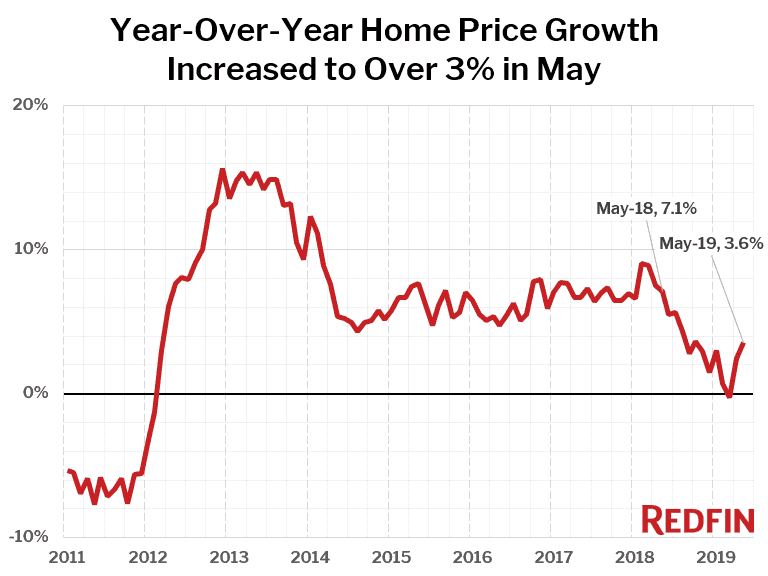

A Redfin analysis shows home prices edged up in May, for the largest year-over-year increase in seven months, which might help justify such optimism.

NAR’s chief economist Lawrence Yun concurs: “With home price appreciation slowing, home sellers understand that the days of large price gains from holding an extra year are over.”

An increased number of Americans also think that now is a good time to buy a home, and of those respondents, 38% answered that they strongly believe that notion, and 27% said they moderately believe the present is a good time to buy. Thirty-five percent disagreed, stating that now is not a good time to make a home purchase, which is unchanged from 2019’s first quarter.

NAR’s second quarter Housing Opportunities and Market Experience (HOME) survey also took a look at consumer attitudes regarding the nation’s economy. Fifty-five percent of those polled said that the economy is improving; that is up from 53% in the previous quarter. Second quarter optimism was greatest among those who earn $100,000 or more and those who reside in rural areas.

NAR reports that 63% of those polled said they believe home prices have increased within their communities in the last 12 months, a slight jump from the first quarter’s 61%.

Respondents were also asked to share their thoughts on future home prices in their neighborhoods. Forty-three percent said they believe prices will remain the same in their communities over the next six months, a figure which is consistent with the previous quarter. Forty-nine percent said they expect to see a price increase in their communities over the coming six months.

Among those surveyed who do not currently own a home, 27% said they believe it would be very difficult to qualify for a mortgage due to their financial state; 30% said it would be somewhat difficult to qualify.

Yun said that mortgage affordability was promising over the second quarter, and he predicts this trend will continue. “Lower mortgage rates, along with job and wage growth, will lead to an increase in sales and thereby contribute positively to economic growth in the upcoming quarters.”