As the commission lawsuits heat up, real estate brokers are gearing up to add buyer representation agreements and training, cut costs and hone value propositions, according to RealTrends Q4 2023 BrokerPulse survey. Only 1% of respondents say they are restructuring their compensation model. About 30% are shoring up agent training and consumer education, while another 25% are implementing buyer representation agreements and increased documentation. Another 10% are honing their value proposition, particularly as it relates to buyers’ agents.

“We are doubling down that all fiduciary relationships with buyers and sellers be in writing and that sellers understand their rights regarding commissions,” said a Keller Williams Real Estate leader in the Northeast.

A Seattle-based broker-owner shared a similar sentiment, “[We are] helping agents with their value proposition when it comes to representing a buyer, specifically when it comes to buyer agency agreements and how to negotiate their compensation.”

The Sitzer/Burnett class action commission lawsuit trial date is October 9. Anywhere Real Estate and RE/MAX both proposed settlements, while Berkshire Hathaway HomeServices, Keller Williams, and the National Association of Realtors plan to fight.

According to an article by HousingWire Reporter Brooklee Han, initially filed in April 2019, the lawsuit takes aim at NAR’s Participation Rule, which requires listing agents to make a blanket offer of compensation to buyers’ agents in order to list the property on a Realtor-affiliated multiple listing service (MLS). According to the plaintiffs, commission sharing inflates the costs for consumers, in violation of the Sherman Antitrust Act. NAR contends that the current commission structure, which has been in place for over 100 years, actually helps consumers.

RealTrends BrokerPulse requests surveys from some 19,000+ real estate brokerage leaders around the nation on market trends and brokerage opportunities and challenges. Of the 131 completed surveys, 25% were from the Southeast, 27% from the Southwest, 17% from the Midwest, 18% from the Northeast and 12% from the Northwest. RealTrends BrokerPulse is a forward-looking, quarterly survey.

Housing sales, prices flat in fourth quarter

Real estate leaders surveyed for the RealTrends Q4 2023 BrokerPulse were more pessimistic about today’s housing market outlook in the fourth quarter than they were last quarter. Some 22% said they were pessimistic, compared with 14% in the Q3 2023 survey. Twenty-eight percent (28%) were optimistic, down from 41% in Q3, and half (50%) were neutral.

In addition, 52% predicted the market would be flat this quarter, similar to sentiment in the third quarter. In Q4 2023, 38% predicted the market would go down, up from 25% in Q3. Only 11% of respondents think the market will go up 5% or more in the fourth quarter.

When it comes to home prices, 60% thought home prices would be flat in the fourth quarter, up from 53% in the third quarter. Twenty-four percent think home prices will be up more than 5% and 16% predicted they would be down more than 5%.

Some 25% (down from 48%) of respondents predict that interest rates will go up this quarter. The same percentage of respondents (25%) said they think rates will go down.

Productivity, motivation and regulation are key

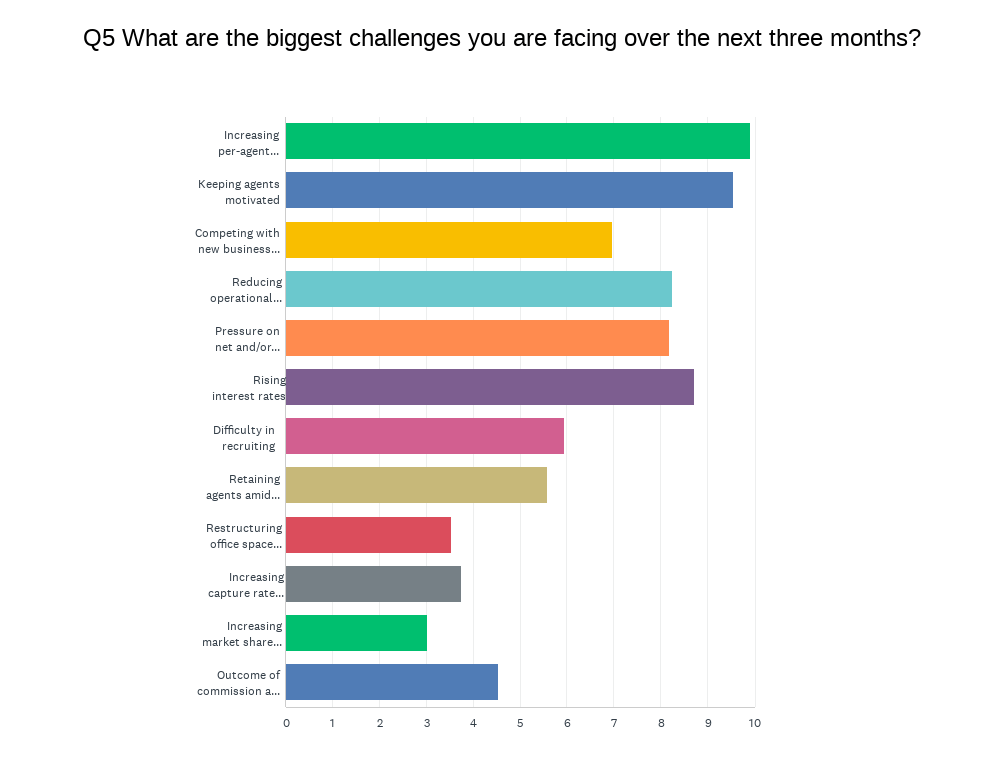

Brokers continue to prioritize increasing per-agent production and finding ways to keep agents motivated as we move through the end of the year. Though brokerage leaders say they are preparing for the outcome of the commission lawsuits, it was low on the list of challenges respondents were most concerned about. It ranked No. 9 of twelve possible challenges.

The biggest challenges rated, beyond the top three, were all related to brokerages’ bottom lines, including reducing operational expenses, pressure on net or gross margins, competing with new business models — particularly low-fee models — and difficulty in recruiting.

Of course, as in all markets, recruiting and retaining agents are top mentions when asked about priorities.

RealTrends also publishes AgentPulse survey which will help brokerage leaders gauge what agents understand about the technology and marketing solutions they find important and offer agents a temperature of the market.

If you have questions about BrokerPulse, email HWMedia’s Senior Director of Data and Content Tracey Velt at tracey@hwmedia.com. Also, be sure to sign up for RealTrends Daily, a roundup of news, tips and strategies for success.