Mortgage Sales in a Purchase-Dominated Market

The Home Mortgage Disclosure Act (HMDA) data set is primarily used to assist in determining whether Financial Institutions are serving the housing needs of their local communities facilitate public entities’ distribution of funds to local communities to attract private investment help identify possible discriminatory lending patterns.

It is also an extensive loan-level data set that can give a glimpse into market dynamics—everything from shifting demand to lender strategies to secondary market patterns—in different market segments.

We looked at five years of HMDA data and focused on some key data points in 2018 to capitalize on the expanded data set. We estimate that HMDA data covers 92-95% of all mortgage transactions in the US. (Some new data fields in 2018 are exempt from reporting, and these are marked as Exempt.)

Major Shift in Borrower Demand

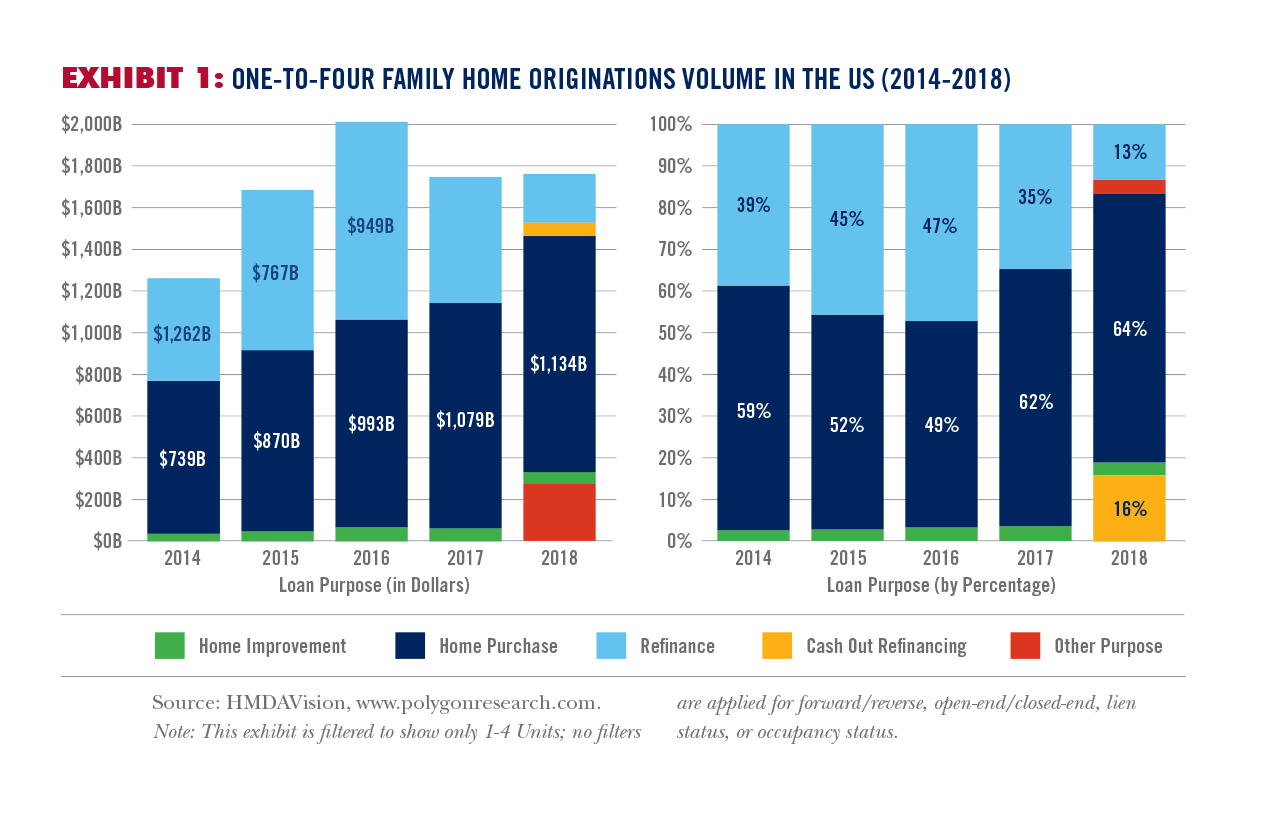

In 2018, the refinance volume for single-family homes, including cash-out refinance, fell to 29% of loan volume, or $509.5 Billion (See Exhibit 1), while home purchase loans reached its highest peak, taking 64% of loan volume, or almost $1.13 Trillion. Over the five years, the refi volume spiked briefly in 2016 to 47% of loan volume, or $946.6 Billion, and then began declining again and falling to its lowest share of overall loan volume for one-to-four units in 2018. The Mortgage Bankers Association forecasts that this share of refi will fall further to 24% by 2022.

Implications For Real Estate Professionals

In light of the MBA estimate that the increased demand for home purchases will dominate in 2019 to the tune of $1.27 trillion, real estate agents once more find themselves at the center of lenders’ attention. Real estate agent partnerships are the dominant strategy of both banks and non-bank lenders when navigating the purchase-dominated market. Real estate agents fill a crucial role in finding unmet demand in a more competitive environment. Lenders, especially some depository institutions which relied on easy refinance volume from portfolio customers, are at a disadvantage as some have made significant reorganizations to their distributed retail sales organizations and have lost the momentum of building trust and long-term relationships with real estate agents and teams.

Handy Facts

Lending to finance purchases for one-to-four family homes in 2018 surged to over 4.32 million loans or $1.13 trillion in loan volume. In 2019, this level is expected to increase to $1.27 trillion.

Lending to finance one-to-four unit home purchases increased (as measured by the compounded annual growth rate in all states annually from 2014 to 2018. Idaho experienced the highest lending yearly growth rate—growing 20.3% per year.

LOAN SIZE

The average loan size for home purchase transactions was $262,310 for single-family home loans, increasing 2.8% annually since 2014.

Who can afford a home purchase loan to finance a one-to-four unit home?

Two-thirds of all purchases of one-to-four units that were financed with a mortgage were by:

33% – People who made between $50,000 and $100,000

22% – People who made between $100,000 and $150,000

12% – People who made between $150,000 and $200,000

How much house did they buy?

Properties valued in the range of $250-300k and $300k-$350k represented the most significant categories, 10% of all properties financed with mortgages, followed by properties in the range of $350k-$400k.

What is the Loan-To-Value (LTV) on their purchase mortgage loans?

One of the data points now available in HMDA data is LTV. Interestingly, we noticed the dominance of high LTV purchase loan originations. This leads to the expansion of the credit box of lenders as they are trying to accommodate the credit needs of non-traditional borrowers. For example, 24.6% of all loans originated for the purchase of a one-to-four unit were in the range of 95% to 100% LTV. The next two categories of LTV ranges for one-to-four purchase loans were 20.7% in the range of 80-85% LTV, and 9.5% in the range of 90-95% LTV.

Second-home financing – who buys second homes, and where do they buy?

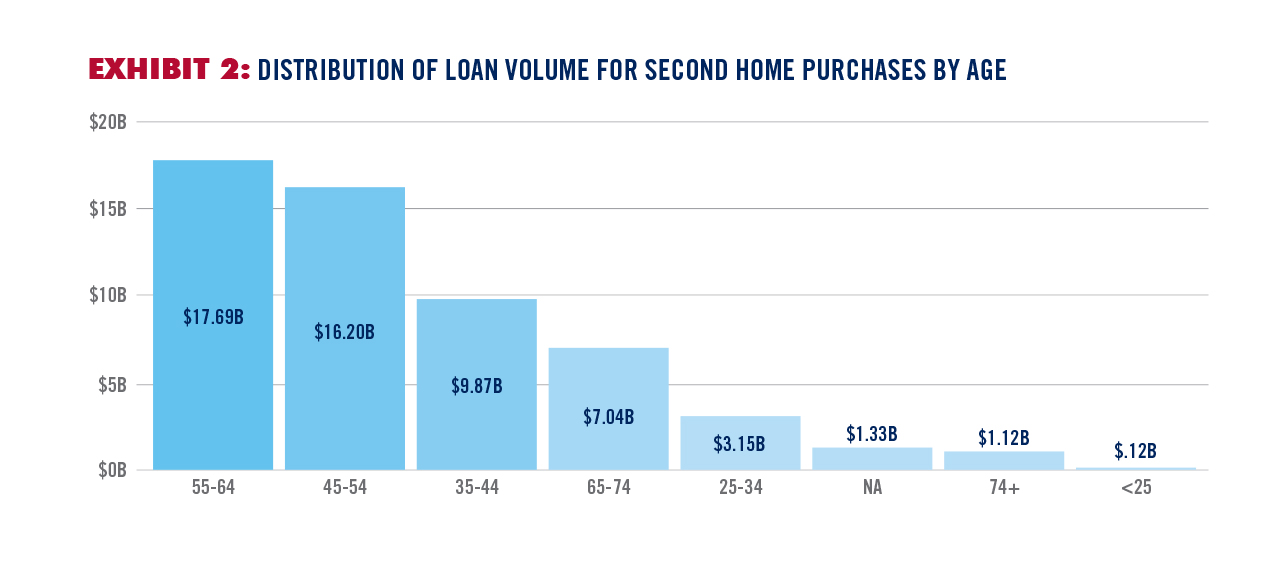

In 2018, there were $56.56 Billion in loans made for the purchase of a second home. The average loan size was $314,866, 20% higher than the overall average home purchase loan size ($262,310). The demand was driven mostly by people in the age range of 55-64, as shown in Exhibit 2. This age group drove 31.3% of all loan volume for second home purchases, or $17.7 Billion.

The largest county by loan volume for a second home, was Maricopa County, AZ with $1.45 Billion in second-home purchase loan volume.

A large portion of second home loan volume, approximately $13 Billion, is in non-metropolitan areas, i.e., outside an MSA. The top three metro markets in which people financed second homes were New York, Los Angeles, and Miami, defined by loan volume for a second home. San Francisco has the highest Average Loan Size, $825,795, for second home residence purchase, followed by Los Angeles with $820,616, and New York with $686,966.

Finally, the Top 50 Lenders for second home financing account for 53% of the loan volume. Wells Fargo, Chase, and Bank of America lead the pack with national and cumulative market share of the top 50 lenders.

We’ll be keeping a close eye on next year’s HMDA release to see if the predictions and trends we’ve discussed persist, which would maintain the steady hand currently held by real estate companies.

Lyubomira Buresch is the President & CEO of Polygon Research, a data and analytics company. Lyubomira is a Certified Mortgage Banker and has worked with Fortune 500 companies, including Bank of America, Citibank, and KPMG.

{{cta(‘a95db50c-87e5-4dde-91cb-3e915197d339’)}}