When discussing housing inequality, we can’t leave anyone out of the conversation. Improving the housing gap means tightening it for all minorities: Blacks, Hispanics and Asians as well as others.

According to the report by the Asian Real Estate Association of America (AREAA), “While it’s true that the overall homeownership rate for Asian Americans and Pacific Islanders is higher than Black Americans and Latino Americans, it still lags behind that of White Americans.” According to the report, some 72% of White Americans own homes, while about 62% of Asian Americans and Pacific Islanders (AAPI) are homeowners.

The report notes a lagging middle income bracket in the AAPI community. “This disparity is important because it indicates significant opportunity for expansion within the middle-income bracket for AAPIs and shows where there is still need for assistance,” according to the report.

“The report puts into perspective what is occurring today within the Asian American, Native Hawaiian and Pacific Islander (AANHPI) community,” said Kurt Nishimura, president of AREAA. “While we are the fastest-growing diverse sector in the nation, those in our middle and lower incomes are not keeping pace in homeownership levels with those for the non-Hispanic White sector. We are also much more comparable than previously discussed to the Black and Hispanic middle- and lower-income households.”

Asian groups moving into new areas

As a real estate agent in your local community, it is important to educate yourself on the demographic data that makes up your neighborhoods and potential buyers and sellers. Especially as different ethnic groups migrate to new areas around the country, veteran agents could find themselves serving a whole new group of homeowners.

The State of Asia America report found wealth is not necessarily the driver of high homeownership levels. While several subgroups within the AANHPI community have increased household income over the last several years, those living in the West and Northeast still find homeownership largely unattainable. For example, in 2021:

- Korean communities had an 18% increase in household income, but of those families, only 3% can afford a home in the West and 7% can afford a home in the Northeast.

- Chinese communities had a 12% increase in household income, but of those families, only 2% can afford a home in the West, 4% can afford a home in the Northeast.

- Vietnamese communities had a 10% increase in household income, but of those families, only 1% can afford a home in the West and 6% can afford a home in the Northeast.

- Hawaiian communities had an 8% increase in household income, but of those families, only 1% can afford a home in the West and 6% can afford a home in the Northeast.

- Japanese communities had a 7% increase in household income, but of those families, only 2% can afford a home in the West and 6% can afford a home in the Northeast.

The propensity to live in some of the nation’s most expensive markets has made homeownership challenging for AANHPI people, one of the drivers of AANHPI migration. The U.S. Census reported that the South saw its AANHPI population grow by 25.2% between 2010-2022, while the Midwest increased by 40.5%.

The migration of these communities has several causes, including an expensive cost of living in major metropolitan areas and the continued rise in remote work. Washington, Florida and Virginia were among the top states to gain new AANHPI residents and many of these new residents are primed to purchase homes.

“The 1.88 million Vietnamese Americans have a 69.2% homeownership rate, the highest of any AANHPI group,” said the report.

However, not every ethnic group included in the AANHPI community is so ready for homeownership, especially in high-cost areas. The typical AANHPI strongholds — like California — see only 0.1%-2% of the AANHPI community as “mortgage ready.” That is a far cry from more affordable areas like Houston, Texas where more than 50% of AANHPI residents can afford to purchase a home.

“It’s clear that the AANHPI community is not a homogeneous group, and each ethnicity has different levels of homeownership that are obviously impacted by home prices where they are situated,” Nishimura said. “The Vietnamese and Filipino communities are great examples of those who are thriving in the more affordable South and Midwest. We also recognize there are ethnicities within the AANHPI community where household income is relatively strong, but homeownership rates don’t reflect this success. We clearly have a lot of work to do.”

Making the dream a reality for Asian homebuyers

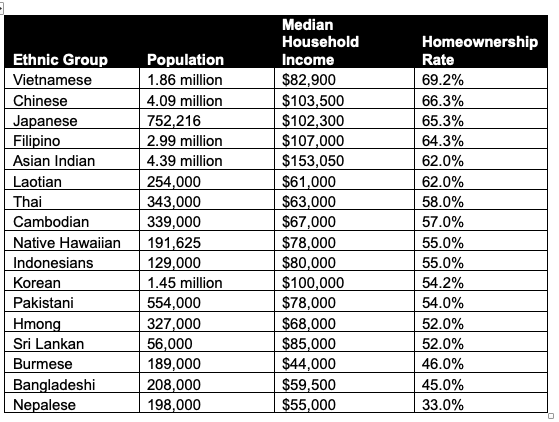

The report broke down homeownership rates by ethic group, see chart below.

Ten of the 17 “studied AANHPI ethnicities fell below the overall U.S. median family income, reported by the U.S. Census to be $70,784,” said the report. This statistic along with other ‘mortgage ready’ qualifications like a credit score of 661 or higher and a debt-to-income ratio below 25%, means that, as real estate professionals, it’s important to educate potential homeowners on what it takes to make the dream of homeownership a reality and the programs available for downpayment assistance and more.

Reach out to the mortgage lenders in your sphere of influence to see what first-time homebuyer programs they are offering. Include that information in your online marketing, cold and warm contacts.

The untapped AANHPI market is primed to purchase homes in your community, and as real estate professionals you must use every tool in your box to work on tightening the homeownership gap.