While rising interest rates and low inventory continue to put the brakes on real estate sales volume, remodeling and renovation activity is strong. For a homeowner sitting on a 3% mortgage rate and substantial equity, it just makes more financial sense to upgrade their current home rather than move out to move up.

While livability is usually the determining factor in a decision to remodel, most homeowners also want to know that the cost is justified by a corresponding increase in value.

Bigger is better, but it also depends…

Plunk has developed a system for simulating projects on individual property and generating an estimate of the value change from that project, taking into consideration the specific attributes of the home and local market conditions.

Most would agree that bigger is better when it comes to houses, and that expanding a small house is likely to generate greater value increase in percentage terms than the same addition to a larger house. But what about at the market level?

One of the projects Plunk evaluates is creating a first floor bump-out. Economists love this kind of marginal change that applies to a majority of cases, as they can compare market outcomes without worrying too much about controlling for other differences.

A closer look at five markets

For this analysis, we chose five of the fastest growing metropolitan statistical areas (MSAs) in the United States over the past decade, all of which have similarly robust real estate markets:

- Raleigh-Cary, NC: 9.8% population growth and 696K current single-family units

- Orlando-Kissimmee-Sanford, FL: 19.7% population growth and 882K current single-family units

- Charleston-North Charleston, SC: 18.5% population growth and 361K current single-family units

- Phoenix-Mesa-Chandler, AZ: 15.6% population growth and 1,480K current single-family units

- Nashville-Davidson-Murfreesboro-Franklin, TN: 15.4% population growth and 378K current single-family units

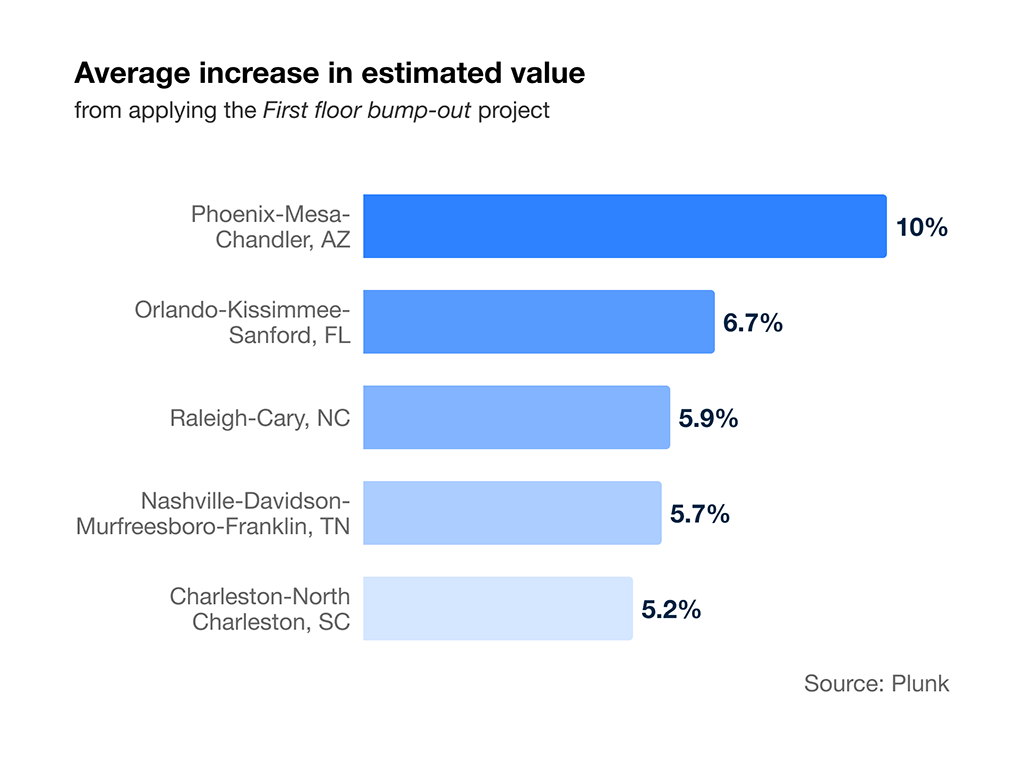

While varying in size, the dynamics of these markets over recent years have all been similar. Simulating the first floor bump-out project across homes in all of these markets resulted in the average increases in estimated value shown below:

As expected, the average value change from this project is positive, but at 10%, the increase for the Phoenix area is nearly double that of Charleston, which has the smallest increase.

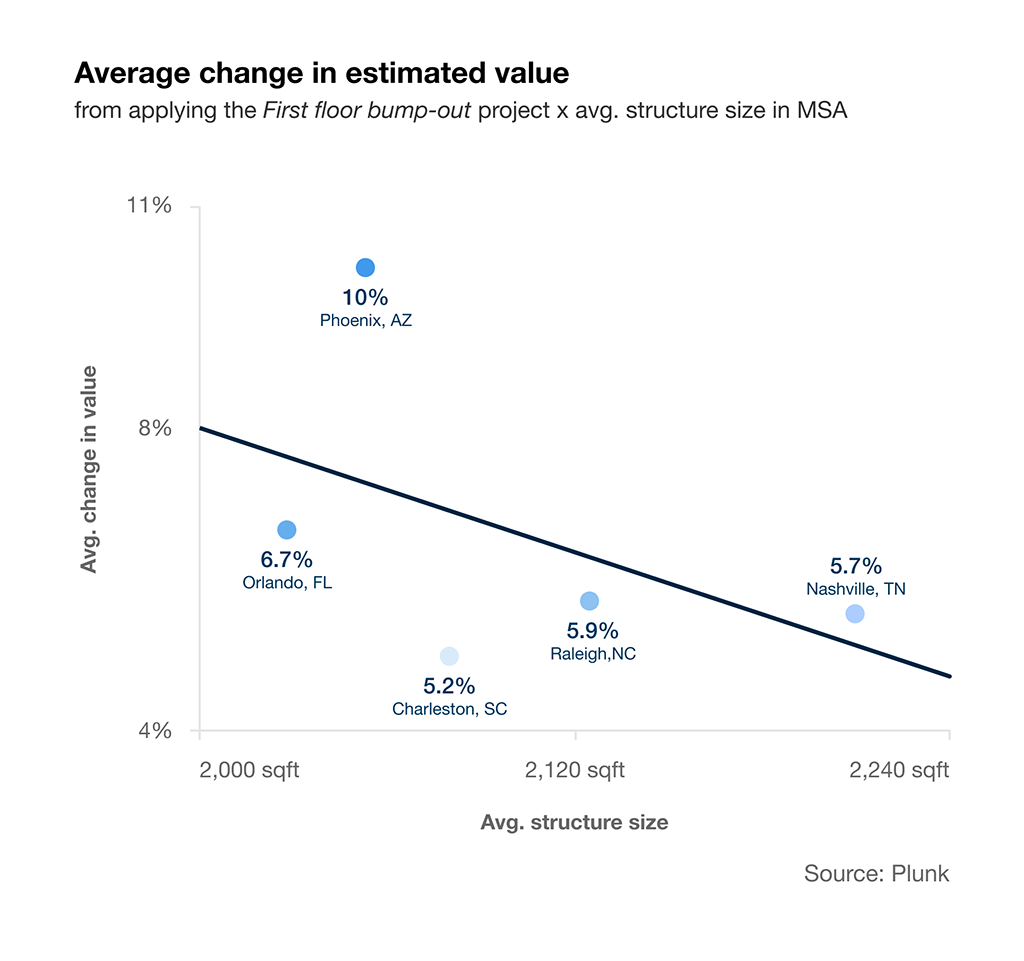

If the expected increase for an individual property depends on the initial size of the house, does that also apply to aggregate statistics at a market level? Let us add in structure size and see what it shows us.

Same renovation project, different valuation

The chart above is a scatter plot of the average increases in estimated value by market according to the average square footage of single-family properties in the market. A regression line has been added to illustrate the average relationship between these two factors across the data points.

Other market-wide factors likely also contribute to the value, but the downward sloping relationship demonstrated here supports the idea that in markets with smaller houses — on average — the return on increasing the size of a house is greater than in places where larger homes are already more common.

In light of that, Orlando and Phoenix seeing the greatest value increase from adding square footage is consistent with what economic theory would predict: That in a market with smaller homes, additional space will be more valuable than in a market with larger homes.

Vince O’Neill is the chief economist of Plunk.